1xBet Uganda Overview

Since its inception in 2007, 1xBet has become a prominent name in the international betting industry. Recognized by millions of users globally, 1xBet stands out for its extensive coverage of sporting events. Bettors on this platform can choose from thousands of events across over 60 sports each day, making it one of the most diverse betting environments available.

1xBet’s commitment to offering a seamless betting experience is evident in its support of over 250 payment systems, ensuring easy and secure transactions. The company’s strong partnerships with leading sporting organizations and renowned football clubs, such as Serie A and FC Barcelona, highlight its significant presence in the sports betting world. The recognition 1xBet has received through various prestigious iGaming awards further confirms its popularity and trustworthiness among both players and industry experts.

Upholding the highest standards of regulatory compliance, 1xBet Uganda operates under the license № NLGRB-GB-82-003 and operational license № NLGRB-C-82-004, both dated January 01, 2023, issued by the National Lotteries and Gaming Regulatory Board of the Republic of Uganda. These licenses signify 1xBet’s commitment to legal and ethical betting practices, assuring users of a safe and regulated platform for their betting activities.

1xBet UG Login

Access your account quickly and securely using the 1xBet login process. Designed for ease and efficiency, it ensures registered members can rapidly engage with a wide range of betting and gaming options. The 1xBet login is optimized for fast and secure access. Below is a straightforward breakdown of the login process:

- Navigating to the Site: Start by visiting the official 1xBet Uganda website or opening the 1xBet mobile app on your device.

- Finding the Login Section: On the homepage, look for the ‘Login’ button. This is typically located in the upper right corner of the screen.

- Entering Your Credentials: Input your registered email address or user ID, followed by the password you created during registration.

- Completing the Login: Click on the ‘Login’ button. Once your credentials are verified, you will be redirected to the main betting interface, where you can start exploring and betting.

Keep in mind, that to access the login feature on 1xBet Uganda, you first need to be a registered member. Successfully registering sets the stage for all your future activities on the platform, including logging in.

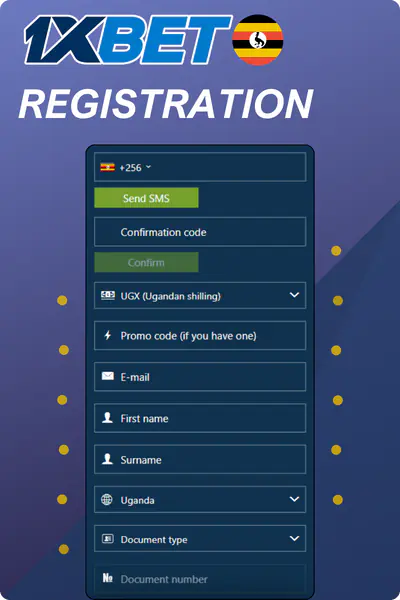

How to Register on 1xBet: A Step-by-Step Guide

Registering on the website opens the door to a world of exciting betting and gaming opportunities, including lucrative bonuses for new users. The 1xBet registration process is straightforward, allowing you to quickly join the 1xBet community. Here’s how to create your account:

- Accessing the Platform: Go to the 1xBet Uganda website or app.

- Initiating Registration: Locate and click on the ‘Registration’ button. This can usually be found near the top of the page.

- Choosing Registration Method: Select how you wish to register: ‘One-click’, ‘By phone’, ‘By email’, or ‘Via social networks and messengers’.

- Providing Required Details: Depending on your chosen method, fill in relevant information such as your phone number, email, and personal details.

- Setting Account Preferences: Create a password and choose currency.

- Applying a Promo Code: If you have a promo code, enter it here to claim specific registration bonuses.

- Finalizing Registration: Agree to the terms and conditions and click ‘Register’ to complete the process.

During the registration process, you have the opportunity to select from various attractive bonuses. You can opt for the sports welcome bonus, which boosts your first deposit by 300%, up to a maximum of 1,250,000 USh. Alternatively, you might choose the Casino + 1xGames welcome package, which offers up to 6,500,000 USh and 150 free spins. These first deposit bonuses, available at the point of registration, are designed to enhance your initial experience on the platform, adding more excitement to your first forays into betting and gaming.

With your new 1xBet account, you can make your initial deposit, claim your welcome bonus, and begin exploring the extensive betting and gaming options available. Whether you’re interested in sports betting, live-action, or casino games, 1xBet Uganda offers an immersive and rewarding experience.

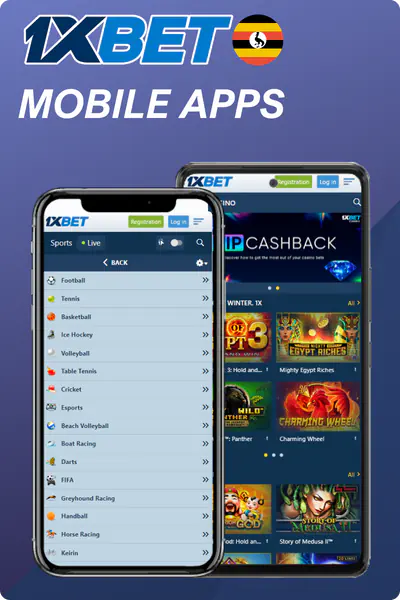

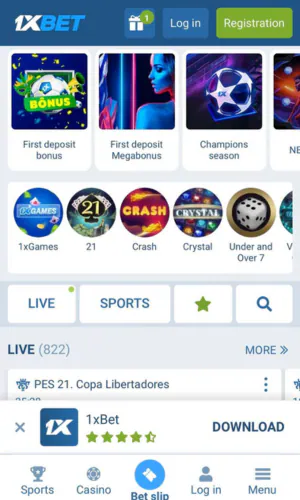

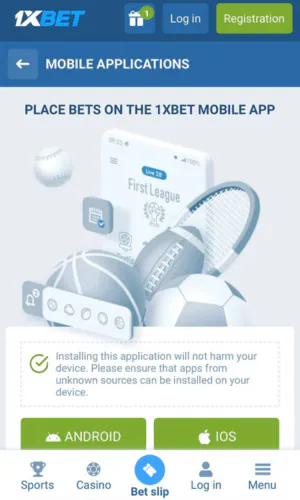

Download the 1xBet Mobile App

The 1xBet mobile version offers a seamless and comprehensive betting experience for users on the go. Compatible with both Android and iOS systems, it ensures that users can access a wide range of betting options anytime, anywhere.

For Android Users: Android device owners need to visit the 1xBet website to download the app. Since the app is not available on the Google Play Store due to policy restrictions, the following steps are essential:

- Visit the official 1xBet website using your Android device.

- Locate the section for mobile applications and select the download link for the Android app.

- Download the .apk file. Before installing, change your device’s settings to allow installation from unknown sources.

- Find the downloaded .apk file on your device and initiate the installation.

For iOS Users: The process for downloading the app on an iOS device is more straightforward, as it is available directly on the App Store:

- Open the App Store on your iOS device.

- Search for the 1xBet app using the search function.

- Download and install the app directly from the App Store.

Once installed, users can log into the 1xBet app with their existing account or create a new one. The app mirrors the desktop site’s betting options, including live betting, sports markets, and casino games, but with a mobile-optimized interface for easier navigation. The 1xBet app offers a more intuitive experience compared to the mobile version, ideal for on-the-go betting.

Bonuses and Promotions on 1xBet

1xBet Uganda stands out for its extensive array of bonuses and promotions, designed to cater to a diverse clientele of bettors and casino enthusiasts. These offers not only enhance the betting experience but also provide significant value and incentives for both new and existing users. Detailed below are some of the key bonuses and promotional schemes currently available:

- Welcome Bonuses: New users are greeted with a choice of welcome bonuses. The Casino + 1xGames welcome package offers up to 6,500,000 USh plus 150 Free Spins. Alternatively, sports enthusiasts can opt for the Sports Welcome Bonus, which provides a 300% bonus on the first deposit, up to 1,250,000 USh.

- Lucky Friday Offer: This weekly promotion allows users to earn a bonus of up to 600,000 USh every Friday with a deposit. It’s a perfect opportunity to boost your betting balance at the end of the week.

- VIP Cashback: 1xBet’s VIP program spans 8 levels, beginning at Copper. Players progress through these levels by engaging with the platform, with each tier providing increased cashback. The cashback is based on all bets placed, win or lose. Top-level players receive exclusive offers, VIP support, and can benefit from using special promo code.

1xBet Uganda regularly updates its promotions with new offers. The minimum deposit required is only 3,000 USh. Check their site frequently for the latest bonuses and how to participate.

Promo Codes on 1xBet Uganda

1xBet promo codes add an extra dimension to the betting experience, offering unique bonuses and opportunities for players. These codes are accessible both to new and existing users and serve as a key part of the platform’s loyalty program.

The Promo Code Store is a feature designed for the most active customers on 1xBet. Here, players can use their accumulated bonus points to purchase promo codes, which can be applied to a variety of sports and betting types. The value of the promo code selected must not exceed the available bonus points in the customer’s account. This system ensures that active players are rewarded for their loyalty, allowing them to choose deposit bonus that suit their betting style and preferences.

1xBet UG Casino

1xBet Online Casino platform offers an immersive and exhilarating experience for casino enthusiasts. With a focus on both quality and variety, the casino features a vast array of games catering to different preferences and styles. From classic slots to modern video slots, table games and more, 1xBet Online Casino ensures that every player finds their preferred form of entertainment. This diversity is complemented by an intuitive interface and seamless navigation, making it easy for both newcomers and seasoned players to engage in their favorite games.

1xBet Casino is committed to fair play and transparency. All games on the platform are powered by renowned software providers and are regularly audited for fairness. This commitment to ethical gaming ensures that players can enjoy a safe and trustworthy gaming environment, where they can play with peace of mind, knowing that the games are fair and their information is secure.

Variety of Casino Games at 1xBet

The 1xBet Casino boasts a comprehensive selection of games, each offering unique themes, features, and opportunities to win. The collection is constantly updated with new releases, ensuring players have access to the latest and most exciting games in the casino world. Here’s a closer look at the variety of games available:

- Slots: The slots section is vast, featuring a range of classic, video, and progressive slots. Players can find everything from traditional fruit machines to modern slots with intricate themes and innovative gameplay mechanics.

- Table Games: For those who prefer strategy and skill, the table games section offers classics like Blackjack, Roulette, Baccarat, and Poker. Each game comes in various versions, offering different rules and betting limits to suit all types of players.

- Video Poker: Combining elements of slots and poker, video poker games are available for players who enjoy a blend of luck and strategy. These games come in various formats, each with unique rules and payout structures.

- Specialty Games: For something different, 1xBet Casino also offers a range of specialty games like Keno, Bingo, and Scratch Cards. These games are perfect for quick play sessions and offer instant wins and gratification.

- 1xBet Games: This exclusive category includes a variety of unique games developed specifically for 1xBet users. These games often feature innovative gameplay and creative themes not found in other categories. They are designed to provide a unique gaming experience that differentiates them from the standard offerings of other online casinos.

This diverse selection ensures that every visit to the 1xBet Casino Uganda is fresh and exciting. Players can explore new games, experiment with different strategies, and enjoy a rich and varied gaming experience. Whether you’re a fan of the traditional casino atmosphere or seeking modern, innovative games, 1xBet Casino has something to offer everyone.

Exclusive Casino Offers

1xBet Casino extends a range of exclusive offers to its players, each designed to enhance the gaming experience with added value and excitement. These offers are tailored to meet the diverse needs of players, ensuring that everyone, from beginners to seasoned enthusiasts, finds something appealing. Here’s a closer look at some of the exclusive casino offers available:

- Welcome Bonuses: New members at 1xBet Casino Uganda are greeted with attractive welcome bonuses. Deposit bonus vary and can include a generous match on your first deposit, free spins on popular slots, or a combination of both, providing a substantial boost to start your gaming journey.

- Reload Bonuses: Regular players can enjoy reload bonuses, providing extra funds or free spins on subsequent deposits. Often tied to specific days or promotional periods, these bonuses encourage continuous play and loyalty. It’s important to consider wagering requirements when using these 1xBet bonuses to understand how they can be best utilized.

- Cashback Offers: 1xBet Casino provides cashback offers that return a percentage of your bets or losses over a certain period. This type of promotion helps mitigate losses and extends your playtime, giving you more chances to win.

- Exclusive Slot Tournaments: The casino regularly hosts slot tournaments with large prize pools. These tournaments encourage competitive play on selected slot games and offer substantial rewards for top-ranking players.

- Seasonal and Event-Based Promotions: 1xBet Casino also introduces seasonal promotions tied to holidays, special events, or new game launches. These offers can include unique bonuses, free spins, or special prize draws.

These exclusive offers are complemented by clear terms and conditions, ensuring players have a fair chance to benefit from them. Staying updated on the latest promotions and understanding their requirements is key to making the most of these opportunities.

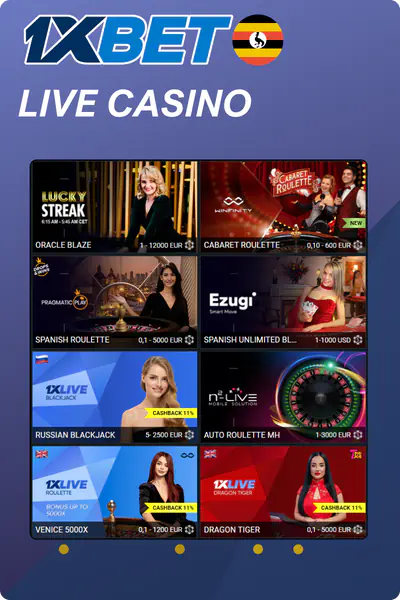

Live Casino: Real-Time Gaming Thrills

The Live Casino section at 1xBet offers an immersive real-time gaming experience, combining the excitement of traditional casino play with the convenience of online access. With live dealers and a variety of games available around the clock, players can enjoy a realistic casino atmosphere from the comfort of their homes. The Live Casino includes:

- A Wide Range of Games: Players can choose from classic table games like Live Roulette, Blackjack, and Baccarat, alongside newer offerings such as Live Poker variants, game shows, and other specialty games.

- Professional Dealers: The games are hosted by professional dealers, bringing expertise and a personal touch to each game. The dealers are trained to interact with players, creating a welcoming and engaging environment.

- Interactive Features: Players can chat with dealers and other players, adding a social element to the gaming experience. This interaction enhances the authenticity of the live casino, making it a preferred choice for many.

- High-Quality Streaming: The live games are streamed in high definition, ensuring excellent visual and audio quality. This high level of production makes for an engaging and seamless gaming experience.

Engaging in live casino games requires understanding the rules and etiquette of live gaming. Players are encouraged to familiarize themselves with the games they intend to play and maintain a stable internet connection for the best experience.

Tips for Ugandan Players

For Ugandan players venturing into the world of online casino gaming, it’s important to approach this activity with knowledge and strategy. Whether you’re a novice or a seasoned player, these tips can help enhance your gaming experience and increase your chances of success:

- Understand the Rules: Familiarize yourself with the rules and strategies of the games you wish to play. Understanding the game mechanics is crucial.

- Manage Your Bankroll: Set a budget for your gaming activities and stick to it. Responsible gaming involves knowing your limits and not chasing losses. This approach helps ensure that gaming remains a fun and sustainable activity.

- Take Advantage of Bonuses: Utilize the bonuses and promotions offered by 1xBet Casino wisely. These can provide additional funds or free spins, but it’s important to read and understand the terms and conditions associated with each offer.

- Practice Responsible Gaming: Maintain a balanced approach to gaming. It’s important to take breaks, avoid impulsive betting, and never gamble under the influence of substances.

- Explore Free Play Options: 1Xbet app offers a free play or demo mode. Use these options to try out new games without risking real money, allowing you to learn and experiment with different strategies.

- Using Welcome Bonus and Promo Code: Utilize the welcome bonus at online bookmaker to boost your initial funds. Also, apply available promo codes for exclusive deposit bonus or extra free spins. Ensure you understand the terms and conditions for each offer to optimize their benefits.

By adhering to these tips, players can enjoy a safer and more enjoyable online casino experience. Remember, the primary goal of gaming should always be entertainment, with winning being a secondary benefit.

Betting Options on 1xBet Uganda

1xBet Uganda offers an expansive array of betting options, catering to a wide spectrum of preferences and interests. The platform’s strength lies in its diversity, providing bettors with access to a multitude of sports, events, and markets. From popular sports like football, basketball, and tennis to niche interests like esports, snooker, and darts, 1xBet ensures that every bettor finds their preferred betting arena. Additionally, the platform offers various types of bets, ranging from simple single bets to more complex accumulator bets, allowing for a strategic and varied betting experience.

1xBet is known for its competitive odds, offering great value bets. The platform features live betting, allowing wagers on events in real-time, enhancing excitement and dynamic betting strategies. Additionally, the use of a promo code can provide extra benefits. The user-friendly and intuitive interface makes it easy for both beginners and experienced bettors to effectively place bets.

Sports Betting: Markets, Tips, and Strategies

1xBet betting UG is an engaging activity that combines knowledge, strategy and a bit of luck. To make the most out of your betting experience, it’s essential to understand the various markets available and to approach betting with informed strategies.

- Wide Range of Markets: 1xBet Uganda offers a comprehensive range of betting markets, including accumulator bet options. This includes traditional choices like match winners, over/under goals, and handicaps, as well as specialized markets such as first goal scorer, correct score, and half-time/full-time results. Each sport features numerous betting options, giving bettors a depth of choice.

- In-Play Betting: The platform offers extensive in-play betting options with minimum bet requirements, allowing bettors to place bets on ongoing matches. This dynamic form of betting demands quick thinking and the ability to predict game evolution based on current trends and performances.

- Esports Betting: Esports has emerged as a popular betting market on 1xBet, featuring major games like Dota 2, CS:GO, and League of Legends. Bettors can wager on various outcomes, including match winners, tournament winners, and specific game events.

To enhance your strategy, stay informed about the sports and teams you bet on, analyze statistics and past performances, and monitor player injuries and team dynamics. Manage your bankroll effectively, avoid emotional betting, and seek value in odds, not just betting on favorites. A successful strategy also involves using a promo code when available. Combining knowledge with disciplined betting practices increases your chances of success and enjoyment of winnings.

Live Betting: Engaging in Real-Time Sports Action

1xBet introduces an electrifying dimension to sporting events, allowing bettors to engage with ongoing events in real-time. This dynamic form of betting offers an immersive experience, as odds and markets are continuously updated based on the live action from the sporting event. The website not only adds excitement but also requires quick decision-making and the ability to read the game as it unfolds. The following are key aspects:

- Variety of Sports: 1xBet’s platform covers a wide array of sports, including football, basketball, tennis, and more. This variety ensures bettors have access to live betting options regardless of their sports preference.

- Range of Markets: The mobile version includes markets like the next goal scorer, total corners, and the next team to score, among others. These markets offer opportunities for bettors to leverage their understanding of the game’s momentum and current scenarios, including placing accumulator bets.

- Real-Time Data and Streaming: 1xBet provides real-time data and, in some cases, live streaming of events. This feature is invaluable for making informed betting decisions based on live action and statistics.

- Quick Bet Placement: The platform is designed for the rapid placement of bets, an essential feature in live betting where odds can change in seconds. This efficiency allows bettors to take advantage of opportunities as soon as they arise during a live event.

Successful live betting involves staying up-to-date with the event, understanding the ebb and flow of the game, and being prepared to react quickly. It’s advisable to focus on sports and events where you have good knowledge and to start with simpler bets before moving on to more complex markets.

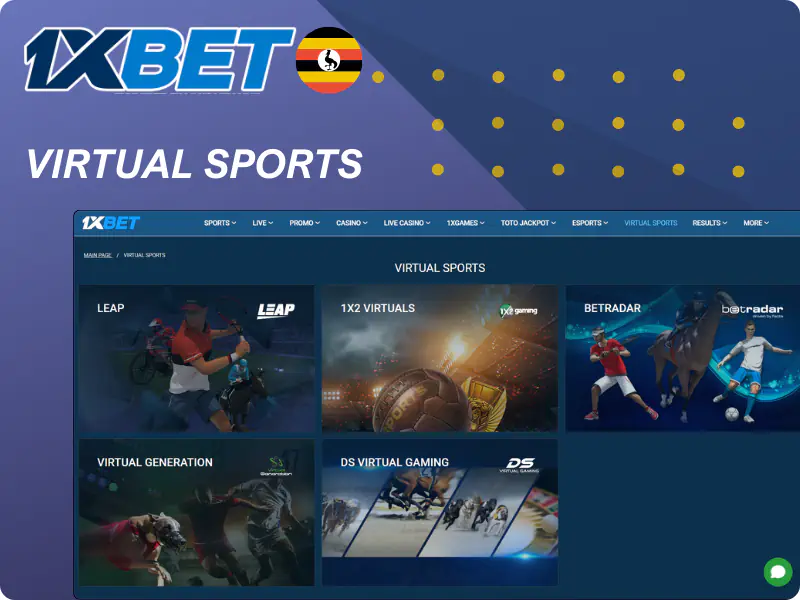

Virtual Sports Betting: A New World of Opportunities

1xBet Uganda’s innovative feature combines sports betting with digital technology, allowing betting on computer-simulated sports events like football, horse racing, and greyhound racing. These events use a random algorithm for fair and unpredictable outcomes. The platform also supports accumulator bets for these virtual sports:

- Diverse Sports Selection: The virtual sports section at 1xBet includes a range of sports, each with its own set of teams, players, and match dynamics. This variety caters to different preferences, ensuring that every bettor finds virtual sports they enjoy.

- Frequent Events: One of the key advantages of virtual sports is the frequency of events. New games or races start every few minutes, offering continuous betting opportunities throughout the day.

- Quick Results: Each virtual sports event is short, typically lasting no more than a few minutes. This quick turnaround means results and payouts are processed rapidly, ideal for bettors looking for instant action.

- Realistic Graphics and Simulations: Virtual sports on 1xBet feature high-quality graphics and realistic simulations, enhancing the visual appeal and making the experience more engaging for bettors.

To enhance your experience with the bookmaker, recognize that virtual sports outcomes are algorithm-generated. Betting strategies should focus on understanding these probabilities. Utilize a promo code where available. Always practice responsible betting and set limits on your bets.

Payment Options: Secure Deposits and Withdrawals on 1xBet UG

1xBet Uganda offers a range of payment options for easy and secure deposits and withdrawals. The platform provides multiple methods including traditional banking and digital wallets, ensuring hassle-free financial transactions. This safe banking environment builds trust and satisfaction among users, making the initial deposit process straightforward and reliable.

Bookmaker ensures all transactions are encrypted, safeguarding users’ financial data and privacy. The platform offers swift transaction processing; deposits are credited quickly for uninterrupted betting, and withdrawals are efficient for timely access to winnings. The minimum deposit amount is just 3000 USh. Customer support is available for transaction-related queries, making financial dealings on 1xBet smooth and reliable.

Understanding Different Payment Methods

1xBet Uganda’s diverse range of payment methods caters to a wide spectrum of users, each with its own set of features and benefits. To aid users in selecting the most suitable payment option, it’s important to understand the different methods available and their specific characteristics. This understanding helps in making informed decisions for 1xBet deposits and withdrawals on the platform.

| Payment Method | Type |

| Bank Transfers | Traditional Banking |

| Credit/Debit Cards | Visa, MasterCard |

| E-Wallets | PayPal, Skrill, Neteller |

| Mobile Payments | Mobile Money Services |

| Cryptocurrencies | Bitcoin, Ethereum, etc. |

| Prepaid Cards | Paysafecard, etc. |

When choosing a payment method, consider factors like processing times, any associated fees, and the convenience of the method. For instance, e-wallets and cryptocurrencies typically offer instant transfers, making them ideal for quick deposits and withdrawals. Traditional bank transfers, while secure, may take longer to process. Understanding these nuances ensures you can manage your funds effectively and enjoy a seamless betting experience on 1xBet, including taking advantage of the first deposit bonus.

Transaction Security and Timelines

At 1xBet Uganda, the security of transactions is paramount, ensuring that users can conduct their financial activities with confidence and peace of mind. The platform employs advanced encryption technologies and security protocols to protect both personal and financial data. This high level of security is maintained across all types of transactions, whether deposits or withdrawals, safeguarding users against potential online threats. In addition to security, understanding the timelines associated with different transaction methods is crucial for effective account management.

| Transaction Type | Security Features | Typical Processing Time |

| Deposits | Encryption, Secure Payment Gateways | Instant to 24 Hours |

| Withdrawals | Advanced Encryption, Identity Verification | 1-5 Business Days |

| Bank Transfers | Two-Factor Authentication, Secure Channels | 1-5 Business Days |

| E-Wallets | Password Protection, Secure Transactions | Instant to 24 Hours |

| Cryptocurrency Transactions | Blockchain Security, Anonymity | Instant |

When transacting, consider processing times: e-wallets and cryptocurrencies often provide instant processing, while bank transfers take longer. Plan deposits and withdrawals accordingly, especially for timely betting opportunities or when quick access to funds is needed. Also, consider these timelines when using the first deposit bonus.

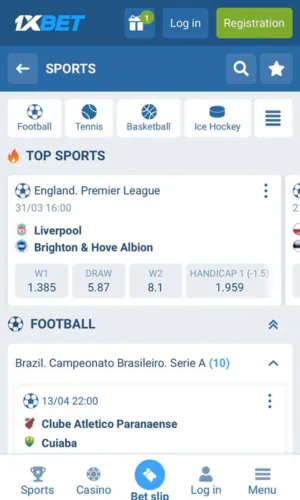

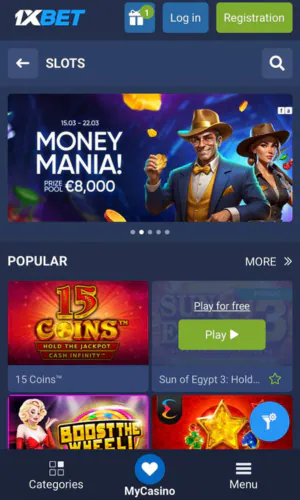

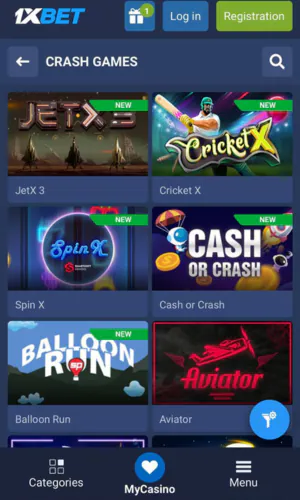

Screenshots of 1xBet

Conclusion

1xBet Uganda, a top online betting and casino platform, offers a wide range of sports markets, diverse casino and crash games, and strong security. Its user-friendly interface, competitive odds, and various betting options cater to sports fans, casino enthusiasts, and live betting strategists. The platform emphasizes customer satisfaction with secure payment methods, efficient customer support, and a focus on responsible gaming.

1xBet Uganda stands out for its advantageous welcome bonus, boosting the first deposit by 300% up to 1,250,000 USh, with a minimum deposit requirement of just 3,000 USh. The platform also offers accumulator bet options, continuously updating with new features and promotions to provide a dynamic and enjoyable betting experience.

Whether you are stepping into the world of online betting for the first time or are a seasoned bettor seeking a reliable and feature-rich platform, 1xBet Uganda stands out as a top choice. With its comprehensive offerings, unwavering commitment to security and fairness, and a user-centric approach, the platform is well-positioned to continue leading and shaping the future of online betting and gaming in Uganda.